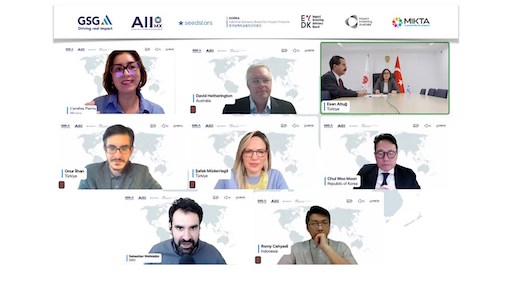

Impact leaders from MIKTA countries join forces for impact investment.

As part of Türkiye’s 2022 presidency of the MIKTA platform, impact leaders from Mexico, Indonesia, Republic of Korea, Türkiye and Australia (MIKTA) launched the ‘Joint Forces for Impact Investing’ Report.

Türkiye, December 15th – National Advisory Boards (NABs) of the Global Steering Group for Impact Investment (GSG), representing MIKTA countries, presented impact investment as a tool to mobilize capital at scale to achieve the Sustainable Development Goals (SDGs) and meet climate change agreements (such as the Net Zero pledges and the Paris Agreement).

The MIKTA platform is a cross-regional group of the five G20 member countries working to bridge divides between developed and developing nations and build consensus on key issues. The Joint Forces for Impact Investing report launch event brought together impact leaders, policymakers and key stakeholders from MIKTA countries to present the shared opportunities for impact investment in the region, alongside the local key challenges and policy recommendations.

The report is a collaborative effort by Impact Investing Advisory Board, Türkiye; Alianza por la Inversión de Impacto, México; Seedstars, Indonesia; National Advisory Board for Impact Finance, Republic of Korea; and Impact Investing Australia, with the support of the GSG.

The report presents impact investment as a proven and fast-growing investment practice within the sustainable finance field and encourages further cooperation among MIKTA countries, and between the impact investing ecosystems and policymakers domestically.

Şafak Müderrisgil, President of the Impact Investing Advisory Board Türkiye, underlined the importance of the report and future potential collaborations:

The report is a preliminary reference reflecting the current status and intended targets of impact investing in MIKTA countries and paves the way for making new policies through their governments as well as collaborations within the MIKTA Platform.

Ambassador Esen Altuğ, Director General of Multilateral Economic Affairs at the Ministry of Foreign Affairs of the Republic of Türkiye, participated in the event on behalf of the Turkish government. She emphasized the importance of impact investment for MIKTA countries, and called for cooperation among its foreign ministries:

As the current MIKTA Chair, Türkiye is pleased to take part in discussions on impact investing organized by our National Advisory Board. Impact Investing is to happen as a new and promising cooperation area for MIKTA partnership.

Sebastian Welisiejko, GSG Chief Policy Officer, moderated a panel discussion with representatives from all five NABs. He reinforced the core role of public finance to attract private investments, as well as the importance of developing impact transparency in the mobilization of capital:

No public budget alone will ever be enough to respond to the pressing challenges ahead of us, and that private capital, working together with the government, has a key role to play. We have a challenge in terms of how we can mobilize more private impact capital to respond to the social and environmental agenda most effectively, while ensuring that this mobilization is more transparent and impactful. This report features some elements of how to deal with both mobilization and impact transparency in MIKTA countries.

National Advisory Boards of the GSG highlighted the most important trends and developments in their countries, as well as key challenges and opportunities they observe locally:

Carolina Puerta, Executive Director of the Alianza por la Inversión de Impacto México:

Creating and developing a consistent impact narrative in Mexico is very important, as there is still confusion with ESG and other terms. Most of the financial organizations are starting to focus on ESG, while they think that impact is equal, or very similar to philanthropy. Raising awareness locally is key, so that the financial sector starts to look at impact investing as a real opportunity.

Romy Cahyadi, Chief Executive Officer of Instellar, Indonesia:

The impact investing ecosystem in Asia is growing very fast with various different forces and stakeholders coming together. Mainstream investors are increasingly interested in learning about impact investment. Working together with the government, we hope to produce a strong action plan early next year to guide us to success.

Chul Woo Moon, Chair of the National Advisory Board, Republic of Korea:

In Korea, excellent opportunities are arising and related policy supports are urgently needed to embed impact investing practices in the areas of climate technology, just transition, employment, post-covid social welfare, and international development aids.

Şafak Müderrisgil, President of the Impact Investing Advisory Board Turkiye:

It is crucial to distinguish impact investing from subjects like CSR and ESG. With the establishment of Turkish NAB, Türkiye became an actor in a global setting to present policies and other applications related to impact investing. We are currently working on the First Social Impact Bond for this February and also incorporating Islamic Finance instruments to the impact investing ecosystem.

David Hetherington, CEO of the Impact Investing Australia:

The new Australian Government is enthusiastic about impact investing and has asked the Impact Investing Taskforce to revisit its 2020 recommendations. The Australian NAB is refining these recommendations for the Taskforce, including the establishment of an II wholesaler.

The National Advisory Boards of the GSG that represent the MIKTA region have pledged to meet quarterly to strengthen collaboration, prepare a follow-up report for 2023, and establish a cross-regional meeting platform to accelerate impact investment in all five countries.

MIKTA NABs also shared their top priority for the year of 2023:

-

- Australia – Securing an impact investment wholesaler.

- Republic of Korea – Creating a climate impact fund with the Korean government and the support of the private capital.

- Indonesia – Creating a blended finance facility of early impact investing.

- Mexico – Aligning the concepts and narrative and raising awareness.

- Türkiye – Incorporating Islamic Finance to be linked to impact investing.

Please click here to download the Joint Forces for Impact Investing Report.

About Impact Investing Advisory Board, Türkiye (EYDK)

Formed in April 2021, Impact Investing Advisory Board, Türkiye (EYDK) has 43 leading public, private, and third sector, institutional members. Its vision is to elevate impact investing into a mainstream investment choice in Türkiye and the surrounding region. EYDK is active in the fields of awareness raising, capacity building, cooperation and networking, and policy advocacy with evidence-based themes of women’s empowerment, refugee livelihoods, sustainable cities, the European Green Deal, and the Istanbul Finance Centre within the context of financial inclusion and participatory finance. Concepts such as venture philanthropy, blended finance, debt markets, and impact entrepreneurship are also within the strategic scope of EYDK. As the paramount market enabler in Türkiye, EYDK has an agile, transparent, and results-oriented approach towards serving the triple bottom line of people, planet, and profit. www.eydk.org

About the Global Steering Group for Impact Investment (GSG)

The Global Steering Group for Impact Investment (GSG) is an independent global steering group promoting sustainable development and advancing education in impact investment. The GSG was established in 2015 as the successor to, and incorporating the work of, the Social Impact Investment Taskforce established under the UK’s presidency of the G8. The GSG’s National Advisory Boards (NABs) currently cover 35 countries. The GSG brings together leaders from finance, business, philanthropy and governments to drive a shift towards impact economies. For more information visit www.gsgii.org and follow the GSG on LinkedIn and Twitter.