The global influence of the GSG is built on a unique and growing group of National Advisory Boards, currently made up of 30 National and Regional Advisory Boards, representing 36 countries. A further 30 NABs are under development, many in lower and lower-middle-income countries.

Greece

Members

Greece

The Hellenic Impact Investing Network (HIIN)

About HIIN

Vision

Mission

They aim to support the creation of a friendly environment for such investments in Greece and to place the country on the global impact investing map, among others through showcasing Greek innovative and pioneering impact opportunities to the global impact investing community.

By deploying capital with purpose, we aim to generate measurable, sustainable, and inclusive outcomes that enhance the well-being of communities and preserve our natural resources for future generations.

Focus & Verticals

They focus and specialize on investment-ready initiatives with return potential and our network works with a “triple goal mindset”.

Therefore, their key-verticals include:

Impact education – impact awareness and education around the nature of Impact Investing itself, as a methodology (local audiences), as well as the attractiveness of the country as a premier destination for impact projects (international audiences)

Impact readiness – for example, helping young entrepreneurs to develop a robust impact business plan and metrics and communicate their offering with the global impact community

Enabling impact – for example, supporting Greek related initiatives around the creation of registered and regulated investment products (e.g. funds, notes, bonds) focusing on sustainability and impact investing

Their targeted audience includes, state linked organizations and entities, Greek, Greece-based or Greece-linked private, corporate and institutional investors, financial corporations, foundations and philanthropic institutions, entrepreneurs, and junior and senior experts and advisors.

Key People

BOARD MEMBERS

Vicky Argiroudi

Nikolaus Hutter

Milit Chrissavgis

Melina Taprantzi

Lina Liakou

Kostis Tselenis

George Platanas

Eleni Theodorou

Dimitris Kontaxis

Dimitris Kokkinakis

Dimitris Georgakopoulos

Antonis Schwarz

Anthi Trokoudi

Angeliki Kosmopoulou

Alexia Spyridonidou

Visit Greece Website

The global influence of the GSG is built on a unique and growing group of National Advisory Boards, currently made up of 37 National and Regional Advisory Boards, representing 42 countries. A further 34 NABs are under development, many in lower and lower-middle-income countries.

Thailand

Members

Thailand

Thailand Investing For Impact (TIFI)

Mission

To mobilize, connect, and synergize an impact investment ecosystem in Thailand to increase the quantity of investments and diversity of investors, while aligning with global opportunities.

Vision

To accelerate inclusive and sustainable development through impact investing in Thailand.

Theory of change

Increasing impact investment deals enables individuals and/or organizations to drive economic growth, improve quality of life, while contributing to reducing the impact of climate change in an inclusive and sustainable ecosystem.

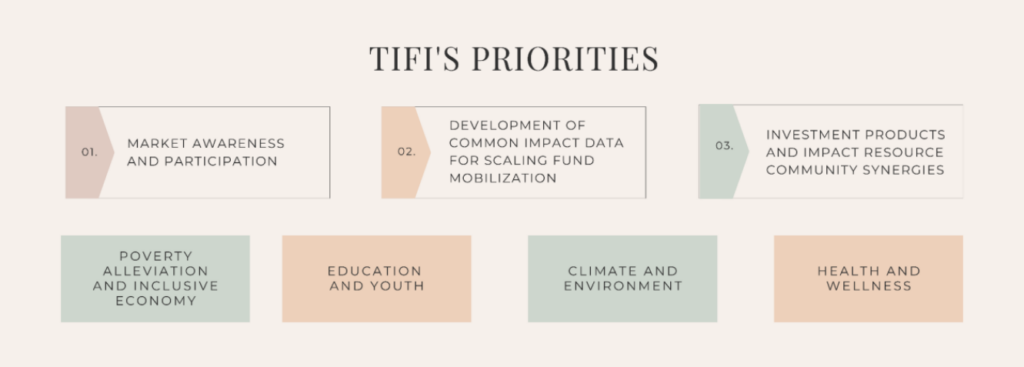

Priorities

Based on the landscape of Thailand’s impact investing, TIFI taskforce members agreed to focus on three main priorities including:

The Steering Committee

EXECUTIVE BOARD

The Steering Committee operates as an executive board, responsible for the TIFI’s overall strategic direction, market insights, and strategic positioning for TIFI.

Ada Chirapaisarnkul

Dr. Boonwara Sumano

Sunit Shrestha

Watanan Petersik

Kesara Munchusree

Krating Ruangroj Poonpol

Professor Dr. Kittipong Kittayarak

Vichien Phongsathorn

Key People

TASKFORCE MEMBERS

The Taskforce members involve 8 representatives from other founding organizations. Taskforce members work closely with the steering committee to identify and execute key activities to accelerate growth of impact investment in Thailand.

Pathit Ongvasith

Aphinya Siranart

Fai Wechayachai

MacKenzie King

Siree Jongdee

Saran Kietmetha

Tarlapraporn Punyorin

Jane Santichaivekin

SUPPORTING ORGANIZATIONS

UNDP

Yunus Thailand

Taejai

Impact Hub

SE Thailand

Disrupt

EEF

Change Fusion

TDRI

ANDE

The global influence of the GSG is built on a unique and growing group of National Advisory Boards, currently made up of 37 National and Regional Advisory Boards, representing 42 countries. A further 34 NABs are under development, many in lower and lower-middle-income countries.

Malaysia

Members

Malaysia

The Malaysian National Advisory Board for Impact Investing

Objectives

Promote National Policy and Foreign Direct Investments: Collaborate with regulatory authorities to strategize more broadly on the regulatory regime applicable to harness the power of capital (source from various sectors and industries) for impact

Increase Supply: Unlock catalytic capital from various partners

Increase Demand: Support mission-driven companies of different stages

Commitment

A dedicated group focused on pushing the national agenda of impact investment forward.

Collaboration

A coalition that consists of a broad set of stakeholders of both the current and potential development of the field.

Communication

A representation of impact principles and goals locally and globally.

Key People

Board Members

Yew Jian Li

Vivien Teu

Keeran Sivarajah

Dr. Melissa Foo

Jane Chang

Norma Mansor

Noor Amy Ismail

Chris Chan

Bryan Lim Tsin Lin

The global influence of the GSG is built on a unique and growing group of National Advisory Boards, currently made up of 37 National and Regional Advisory Boards, representing 42 countries. A further 34 NABs are under development, many in lower and lower-middle-income countries.

Norway

Members

Norway

Norwegian National Advisory Board for Impact Investing

About NorNAB

NorNAB is an independent membership-driven organization that works for the growth and development of the impact investment ecosystem in Norway.

Our members include those seeking capital, those providing it, and those helping to make these deals happen to achieve the United Nations Sustainable Development Goals.

Mission & Purpose

NorNAB works to develop a strong impact investment ecosystem out of Norway, driving more capital towards initiatives that accelerate the achievement of the Sustainable Development Goals.

Vision

A thriving Norwegian impact investing ecosystem benefitting people and planet.

Impact Driven

Inclusive

Action Oriented

Key People

BOARD

Signe Sørensen

Maria de Perlinghi

Marte Løfman

Jonas Skattum

Lars Erik Mangset

Solveig Sundsdal

Espen Daae

MEMBERS

Care

KRONPRINSPARETS FOND

Link Capital

conduit

S HUB

Argentum

Berngaard

Sintef

Ramboll

Katapult

OBR

Laerdal

Norfund

Investinor

Impact Startup

Cubera

Oslo Tech

TDV

Thomessen

SOS Kinderbyen

Grieg Investor

Grieg foundation

Norselab

Nysnø

Ferd

Wilstar

Visit NorNAB Website

The global influence of the GSG is built on a unique and growing group of National Advisory Boards, currently made up of 37 National and Regional Advisory Boards, representing 42 countries. A further 34 NABs are under development, many in lower and lower-middle-income countries.

Turkiye

Members

Turkiye

A cross-sector coalition for impact investment

Mission & Purpose

The EYDK aims to create an enabling environment to facilitate the growth of impact investing and to establish a well-functioning ecosystem in Turkiye. The EYDK has the vision to make impact investing become a mainstream, sustainable and inclusive investing choice in Turkiye.

Key People

Our Team

Şafak Müderrisgil

Tuğçe Söğüt

Hüseyin Yılmaz

Ceren Toraman

Badenur Özcan

Pelin Burgu

Ece Alkan

Ceyhun Kocal

Bedriye Karaarslan

Visit Turkiye Website

The global influence of the GSG is built on a unique and growing group of National Advisory Boards, currently made up of 37 National and Regional Advisory Boards, representing 42 countries. A further 34 NABs are under development, many in lower and lower-middle-income countries.

Peru

Members

Peru

Mission & Purpose

Aliados de Impacto (Impact Allies) is the name of the National Advisory Board in Peru. Aliados de Impacto is made up of multisector and multidisciplinary organizations representing the public, private and civil society sectors. It seeks to catalyse the scaling of impact investing in Peru with the aim of facilitating access to capital, knowledge and networks for high-impact ventures and projects, while making the impact investment sector visible and promoting its growth at the national level.

We believe that sustainable change in the country requires the promotion of investments with a proven net social and/or environmental impact, which contribute to the development of a sustainable economy.

Build Knowledge

Connect

Develop

Be Effective

KEY RESOURCES

Key People

EXECUTIVE BOARD MEMBERS

Verónica Sifuentes

Micaela Rizo Patrón

Jorge Farfan

Carlos Rodrich

Carla Grados

Alfredo Estrada

Christian Clement

Mariella Belli

María Pía Morante

Key People

ADVISORY BOARD MEMBERS

Aimi Yamamura

Ana Maria Choquehuanca

Vicente Tuesta

Vanina Farber

Oscar Caipo

Carolina Trivelli

Aldo Ferrini

Pedro Grados

Visit Peru Website

The global influence of the GSG is built on a unique and growing group of National Advisory Boards, currently made up of 37 National and Regional Advisory Boards, representing 42 countries. A further 34 NABs are under development, many in lower and lower-middle-income countries.

Belgium

Members

Belgium

IMPACT FINANCE BELGIUM

Mission & Purpose

IFB’s mission is to increase the share of impact capital in Belgium. Its goal is to mobilize more impact-driven investment, capital and funding to seed and accelerate solutions addressing the needs of people and planet. IFB integrates all capital providers who strive for measurable impact. IFB strives to become the central entity in Belgium, by creating transparency, facilitating access to knowledge, focusing on research and advocacy and engaging with large institutional players.

IFB CEO Frederik van den Bosch commented: “IFB is incredibly excited to be part of the global GSG network. Belgium is a country with a lot of untapped impact potential within the country, both for sourcing and deployment of impact funding. We look forward to putting all our efforts into becoming the central point for impact finance in Belgium. In those efforts, IFB has much to learn from other NABs, or to develop with other NABs”.

Key objectives:

-

Raise awareness and build capacity with investors, capital providers and funders on their impact journey.

-

Create transparency, initiate applied research and facilitate access to knowledge, experience and the broad impact finance space overall.

-

Explore novel (financial) instruments along the spectrum that can boost the impact space.

-

Co-operate, as a trusted convener and partner to financiers across the spectrum of capital, together with all actors and stakeholders in the impact eco-system.

Key People

BOARD DIRECTORS

Piet Colruyt

Jérémy Leroy

Aline Buysschaert

Loïc de Cannière

Céline Vaessen

Steven Serneels

Key People

TEAM MEMBERS

Frédéric Madry

Wendy Braeken

Riqqah Haniyah

Solène Collin

Diane Delava

SUPPORTING ORGANIZATIONS

KOIS

AG insurance

Triodos Bank

PMV

Finance invest Brussels

Incofin

Ethias

Impact Capital

Puilaetco

KBC

ABN Amro

BNP Paribas Fortis

DPAM

SFPIM

King Baudouin Foundation

Visit Belgium Website

The global influence of the GSG is built on a unique and growing group of National Advisory Boards, currently made up of 37 National and Regional Advisory Boards, representing 42 countries. A further 34 NABs are under development, many in lower and lower-middle-income countries.

Sri Lanka

Members

Sri Lanka

Sri Lanka National Advisory Board For Impact Investing (NABII)

Mission & Purpose

Impact investment has made steady progress Sri Lanka over the past several years with a growing body of investment professionals becoming involved and steady building of awareness among the civil society and within government. Nevertheless, impact investment is still at a nascent stage.

Mission

Facilitating an impact investing ecosystem in the country by means of channeling impact investments into the country in partnership with like-minded stakeholders.

Vision

To Drive Impact Capital to Fast-track the Achievement of UN SDG’s in Sri Lanka.

Key objectives:

- Mainstreaming Impact investing and impact entrepreneurship in Sri Lanka through channeling impact investments.

- Educating Sri Lankan stakeholders on the values of impact investing, impact measurement and social entrepreneurship.

- Creation of a network of impact enterprises who are ready to receive impact investments.

- Creating a culture of applying gender lens into investing.

- Facilitating partnership opportunities among Sri Lankan and international stakeholders focused on impact investing.

- Keeping track of the globally changing impact investing ecosystems and mapping out and updating the local impact investing eco system with relation to global practices

- Creating a database and quality research

Promote

Articulate

Raise Awareness

Be Recognized

KEY RESOURCES

Key People

Board Directors

Dr. Lalith Welamedage

Mr. Chandula Abeywickrema

Key People

Board Members

Ms. Achala Samaradiwakara

Mr. Prins Perera

Mr. Sanjay Wijemanne

Mr. Romani de Silva

Dr. Nirmal De Silva

Supporting Organizations

Visit The Sri Lankan Website

Towards An Impact Economy

Mission & Purpose

Creating a Dutch impact-driven force to achieve the SDGs

Mission & Purpose

Vision: In a healthy impact investment ecosystem, investments and savings help solve social and environmental challenges, as well as seek a financial return.

Mission: Increasing the effectiveness of the Dutch impact investment ecosystem to achieve the SDGs.

Values: The NAB reflects the shared values of its stakeholders: ACT: Action-oriented, Collaborative, Transformative.

Board Members

See the NAB Board of Directors

Key People

Management

- Nothing found